Disability Insurance

If an illness or injury stops your paycheck, this keeps your life moving—so you can focus on recovery.

Protect your paycheck. Preserve your lifestyle.

Income Replacement

Straightforward protection for a specific period—10, 20, or 30 years.

Customizable Riders

Enhance your plan with add-ons like COLA or partial coverage.

Flexible Term Length

Choose short- or long-term coverage that fits your needs.

Illness & Injury Benefit

Protects against both illness and accidental injury.

Tax Advantages

Most benefits are tax-free if premiums are paid post-tax.

Peace of Mind

Disability coverage that lets you focus on healing, not bills.

What Is Disability Insurance?

Disability insurance is designed to replace a portion of your income if you’re unable to work due to illness or injury. Whether you’re out for weeks or years, it helps you stay on track financially while you recover.

Key features of a Disability Insurance policy:

- Short-term or long-term coverage options

- Monthly benefit payments (often 50–70% of your income)

- Covers illnesses, injuries, and recovery periods

- May be available through employers or private carriers

Is a Disability Insurance Policy Right for You?

Disability Insurance Makes Sense If You…

- Need your paycheck to support your household

- Lack savings to cover months or years off work

- Work in a physically or mentally demanding field

- Want long-term financial protection

It Might Not Be Ideal If You…

- Already have full income coverage through work

- Are already retired or financially independent

- Premiums don’t fit your budget and risk profile

- Prefer to rely on emergency funds for income gaps

Not sure which category you fall into?

That’s exactly what we’re here for!

A quick call with our team can help you determine whether disability insurance fits your goals—and what type of coverage makes the most sense based on your income, profession, and financial priorities.

How it Works

You choose a policy based on how much income you want to replace and how long you want benefits to last (e.g., 2 years, 5 years, or until retirement age, depending on the policy).

If you become disabled and can’t work, your policy pays a monthly benefit after a short waiting period—helping you cover expenses while you recover.

Benefits:

- Customizable plans to fit your budget and profession

- Tax-free income if you can’t work due to illness or injury

- Short- and long-term coverage options

- Optional riders for more personalized protection

Meet the IFW Life Insurance Team

With over 35 years of experience, our team helps professionals, business owners, and families protect their income and financial goals with the right disability insurance strategy.

We’re fully independent, so we compare top carriers and guide you to the best fit—no pressure, just clear advice and coverage that works for you.

Our Carriers

We partner with over 37 top-rated life insurance companies to give you access to the best coverage options on the market.

Because we’re not tied to one carrier, we can shop around and build the right plan for your needs, budget, and goals.

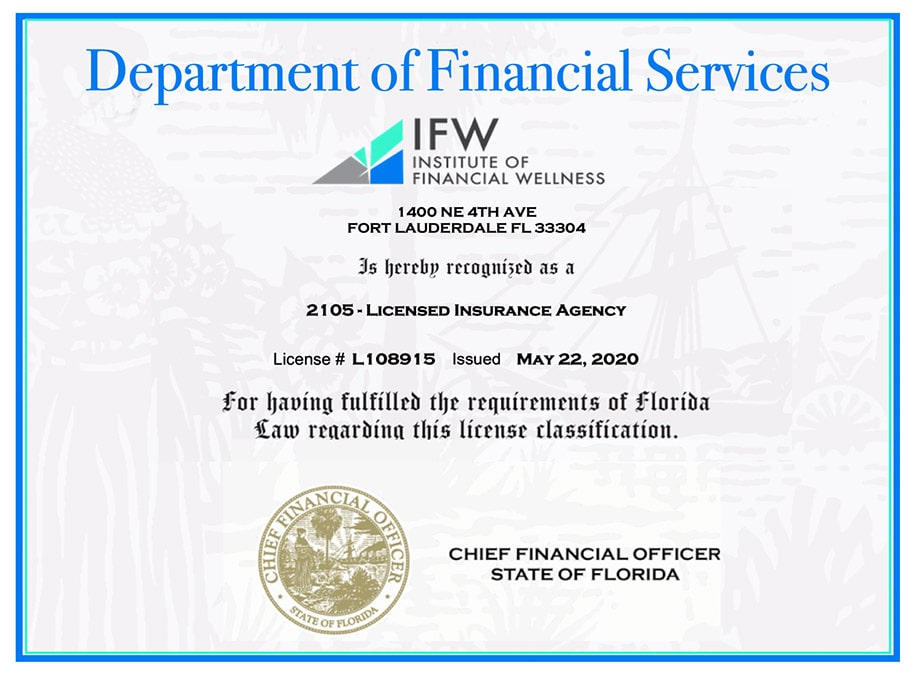

Licensed & Trusted

Licensed in all 50 states, our IFW Life Insurance specialists are ready to deliver expert guidance you can trust. Backed by compliance and expertise.