Critical Illness Insurance

Lump-sum cash payouts for cancer, heart attack, stroke, and more—so you can focus on recovery, not bills.

Focus on Healing—We’ll Handle the Rest

Specific Illnesses

Tailored coverage for life-altering conditions like cancer or a heart attack.

Income Protection

Replace lost income while you recover so your finances stay steady.

Fast Coverage

Quick application and approval so you’re protected when it matters most.

Lump-Sum Payout

Get cash fast after a covered diagnosis—no red tape.

Simple Process

No networks or reimbursements—just direct payment to you after a diagnosis.

Complementary Care

Works with your existing health insurance to fill financial gaps during a crisis.

What Is Critical Illness Insurance?

Critical illness insurance pays a tax-free lump sum if you’re diagnosed with a covered condition. It fills financial gaps after a serious diagnosis—without replacing your health insurance. Unlike medical coverage, it pays you directly, not your provider. Use it to:

- Cover treatments or out-of-network specialists

- Pay your bills while off work

- Handle deductibles or travel expenses

- Keep your family financially afloat

Is a Critical Illness Insurance Policy Right for You?

Critical Illness Insurance Makes Sense If You…

- Have a high-deductible health plan or low savings

- Have a family history of serious conditions

- Are self-employed or don’t get paid time off

- Want to shield your savings from high medical bills

It Might Not Be Ideal If You…

- Have savings or long-term disability coverage

- Prefer to rely solely on health insurance for care

- Can’t afford the added premium cost

- Have pre-existing conditions limiting eligibility

Not sure which category you fall into?

That’s exactly what we’re here for!

Our licensed professionals can help you weigh your options, compare plans, and decide if critical illness insurance fits into your financial strategy.

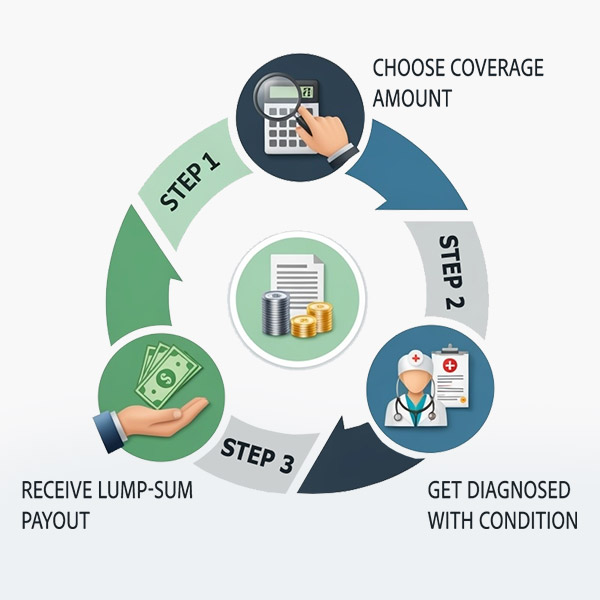

How it Works

Choose a benefit amount—typically between $10K and $100K+. If diagnosed with a covered illness (like cancer, heart attack, or stroke), you’ll receive a tax-free lump sum, usually within 30 days.

Critical illness coverage doesn’t replace health insurance—it helps you stay financially stable during a health crisis.

Benefits:

- One-time tax-free payout upon diagnosis of a covered illness

- Money goes to you to use however you need—no restrictions

- Affordable premiums for high-impact coverage

- Can be added to life insurance for bundled protection

Meet the IFW Life Insurance Team

We’ve been helping families, business owners, and professionals for over 35 years protect their finances from the high costs of serious illnesses like cancer, heart attack, or stroke.

We’re fully independent, so we shop top carriers and help you find coverage that fits your needs and budget. No pressure, just straight talk and smart protection for the what-ifs.

Our Carriers

We partner with over 37 top-rated life insurance companies to give you access to the best coverage options on the market.

Because we’re not tied to one carrier, we can shop around and build the right plan for your needs, budget, and goals.

Licensed & Trusted

Licensed in all 50 states, our IFW Life Insurance specialists are ready to deliver expert guidance you can trust. Backed by compliance and expertise.